- The Edge Newsletter

- Posts

- 12 Top DeFi Yields to Farm While Our ETH Bags Are F*cked

12 Top DeFi Yields to Farm While Our ETH Bags Are F*cked

If we're gonna hold ETH, we might as well farm some yield.

My frustration with ETH’s underperformance against other major crypto assets over the past year is at an all-time high. Sometimes, I wonder if I have a mental illness for holding and even accumulating ETH as a long term store of value.

Yet, despite the price action, I remain a steadfast ETH investooor. ETH sits at the center of the most active onchain economy in DeFi, making it one of the most productive assets in crypto. With ETH, you can:

Stake

Lend

Borrow against it

Provide liquidity

Yield farm

Use it for perps leverage

This post is for anyone in the same boat—still convinced our ETH thesis will play out, that it’s undervalued, and that a violent repricing is inevitable. But until then… we farm.

Below, I’ve curated a list of the best ETH yields right now. Some are from newer protocols, while others are from familiar names. I’ll break down why I like each one and, in many cases, why I’m farming them.

The ETH-based yields in this list meet the following criteria:

1️⃣ Scalability – Each yield can support new deposits of at least $1 million.

2️⃣ Protocol Size – Each protocol has a Total Value Locked (TVL) of $10M or more.

3️⃣ ETH Exposure – The yield is directly tied to ETH or ETH-correlated assets (ie LRTs).

4️⃣ Risk Management – Minimal exposure to impermanent loss or liquidation risk.

5⃣ Passive - Requires no active management on the part of the user

Thanks to all our sponsors for making it possible to share this content for FREE!

🖥️ PYTH | SMARTER DATA FOR SMARTER CONTRACTS

⌛️ HOURGLASS | LEVERAGE AIRDROP FARMING

📊 iYIELD | YOUR FINANCIAL PICTURE, SIMPLIFIED

🐐 GOAT NETWORK | A BITCOIN L2 TO EARN WITH BTC & DOGE

📈 DEFINITIVE | THE MOST ADVANCED PLATFORM FOR ONCHAIN TRADING

Lend ETH on Aave - 2.49% APY

Old faithful! It seems silly I have to remind myself of this, but did you know Aave V3 Core on Ethereum Mainnet currently pays 2.65% APY to ETH lenders?

Why I like it: Aave V3 holds billions in value, minimal smart contract risk, reliable borrower demand but even more reliable to withdraw liquidity at a moment’s notice.

How to farm: Go to app.aave.com, choose a supported network, but I prefer Ethereum Core Instance due to the consistent demand driving lending rates 2-3%.

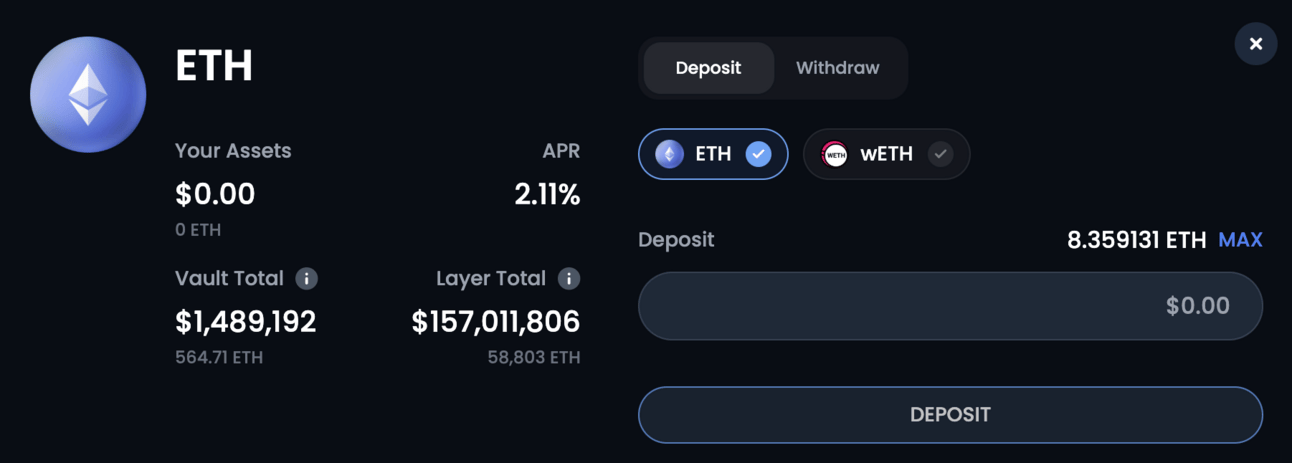

Lend ETH on Fluid - 2.11% APY

Fluid has become the talk of the town among DeFi enthusiasts—considered to be one of the few 0-to-1 innovations in DeFi this cycle. Fluid combines the utility of a lending/borrowing platform with a DEX and turns collateral and debt positions in CDPs into passive liquidity positions to earn trading fees.

Fluid recently achieved new all-time-high trading volume during the market crash, and accounted for over 10% of all DEX volume on Ethereum.

How did @0xfluid do today?

- No bad debt

- Highest trading day at $380M in volume and 10.8% market share on Ethereum

- Liquidations were processed smoothly

- Day with highest fee & revenueDue to the very severe & sudden market crash some users had 100% of liquidation of their… x.com/i/web/status/1…

— Samyak Jain 🦇🔊🌊 (@smykjain)

3:52 PM • Feb 3, 2025

Why I like it: Fluid is built by Instadapp, and while Fluid is newer, Instadapp has never suffered an exploit. Fluid not only has established borrowing demand comparable to competitors like Aave but also attracts loopers to its platform thanks to Smart Collateral and its new Multiply leverage feature. In this case, I’m just lending ETH to be borrowed against blue chip collateral like wstETH, wBTC, and cbBTC.

How to farm: Go to the Fluid app under Lend and follow the prompts to deposit ETH or WETH on Ethereum, Arbitrum, or Base. The 2.1% APY yield can be found on Ethereum Mainnet. I could also lend wstETH instead and earn a combined 4.44% APY thanks to passive liquid staking.

Lend ETH to Moonwell Flagship ETH Vault - 4.43% APY

Built by Coinbase alums, Moonwell is one of the flagship protocols of Base for borrowing and lending. This specific vault exposes lenders to blue-chip collateral markets curated by Morpho, where lenders can earn borrowing interest for their ETH.

Moonwell cleverly leaned into a strategy to work with the open infra for loans built by Morpho instead of concentrating all effort on building borrowing demand only on Moonwell. When depositors enter this vault, their ETH is redirected to Morpho borrowers who can borrow against their collateral such as wstETH, cbBTC, cbETH, rETH, and USDC.

Why I like it: The yield is about 50% native borrowing demand, which aligns with ~2% found on Aave or Fluid, but on top of this, lenders earn another 2% in MORPHO + a little more in WELL. Morpho smart contracts are well understood, beautifully simple, and battle-tested. Although Morpho and Moonwell are much newer than Aave, I believe this is becoming one of the safer places platforms to lend.

How to farm: Go to Moonwell app here on Base to deposit ETH and start earning yield, with claimable rewards in MORPHO + WELL.

Ignore the 4%, the most updated numbers on Morpho show 4.43% APY

hyETH by Index Coop (Morpho) - 9.28% APY

hyETH is designed to track and gain exposure to some of the highest ETH-denominated yields in DeFi. It has recently emerged as a top ETH-based yields we track weekly in Yields of the Week. The yield is mostly sourced from borrowing demand for WETH as Gauntlet lends WETH across a curated group of Morpho Markets.

Why I like it: The 7.69% APY is from borrowing interest and just 1.34% APY is backed by MORPHO rewards. Obviously, the yield stands out for being so much greater than your average ETH staking rate or borrowing rate on money markets like Aave.

How to farm: Go to Morpho hyETH Index Coop vault to deposit WETH here.

Tokemak autoETH Autopool - 8.18% APY

Tokemak Autopools autonomously rebalance LP positions across a set of DEXs and assets, while providing holders an ERC-4626 token that could potentially be used in other composable DeFi. It means you get all that complexity under the hood but maintain the flexibility to further leverage your liquidity elsewhere.

Why I like it: The yields are well understood, a combo of Curve and Balancer LPs using ETH, LSTs, and other ETH derivatives like pxETH, making up more than half the yield while the other half is TOKE rewards.

How to farm: Go to Tokemak app here under autoETH to deposit ETH.

Lend ETH on Gearbox - 4.54% APY

Gearbox is the ultimate hub for providing onchain credit to degens. It specializes in providing leverage for looping farming strategies, margin for long/short pairs, and multicollateral loans. It attracts farmers who want to loop up LRTs like ether.fi eETH 14x and earn 27x points, but as a lender, you don’t face the risk of liquidation or fees blowing up some borrowers—you just sit back and earn yield passive yield from the demand to borrow WETH.

Gearbox currently has $75M in deposited liquidity and has seen dramatic growth the last few years alongside a rise in interest of liquid restaking, Ethena, and new liquid yield-bearing BTC like LBTC. They’ve got a dedicated user community along with the original founders still focused on growing Gearbox.

Why I like it: For all the reasons above, plus I have faith this platform will continue to grow demand from degens, and the 4.54% APY for WETH lenders is mostly organic borrowing interest (3.68% APY) plus a bit more (0.85% APY) in GEAR rewards.

How to farm: Go to Gearbox ETH V3 pool to lend here.

Lend/Hold/LP with pufETH - Up to 51% APY

Puffer started out as strictly an ETH LRT (pufETH offering 3.9% APY) but has evolved into a protocol more focused on the upcoming launch of a based rollup called Puffer UniFi. Underpinning that launch are countless DeFi opportunities for their flagship pufETH. Below is less than a third of the opportunities currently earning real yield + PUFFER rewards over the span of 2-week campaigns that will continually inject new incentives, meaning higher APYs for farmers.

The opportunity to highlight is yet another one built on Morpho—lending WETH to borrowers collateralizing pufETH and borrowing WETH here on Morpho.

Why I like it: Similar to the other Morpho-based strategies, we’re reliant on battle-tested infra with users who are borrowing at fairly conservative LLTVs of 86% with correlated assets. The real yield here for lending WETH is comparable to what we get at 2-3% on Aave but on top of that, there’s substantial PUFFER rewards currently raising the total yield to 51% APY.

How to farm: Go to the Morpho app here to deposit WETH into the Re7 WETH Morpho Vault curated by Re7 Labs. Track the rewards you’re earning here on Merkl.

Restake with cmETH by mETH Protocol - 3.2% APY

Like pufETH, restaking ETH with cmETH opens up a world of DeFi yields while earning a passive staking yield of 3.2% APY. With $1.3B in mETH + $682M in cmETH, there is an ongoing campaign called Methamorphosis Season 2 to incentivize more DeFi activity with cmETH. Below is some of the DeFi you can use to earn POWDER with cmETH (POWDER = points towards their next airdrop of COOK).

FYI: The mETH Protocol was incubated by Mantle.

Why I like it: Nothing’s easier than passive staking/restaking yield, plus you earn points towards EigenLayer, Karak, Symbiotic, and Veda. Knowing this team, I also can attest there’s a long term commitment to deep liquidity in cmETH and adding more DeFi to support cmETH. You won’t run out of options to use your cmETH.

How to farm: If you don’t have mETH already (an LST), stake ETH for mETH on Ethereum Mainnet here. Then, go here to Restake and Bridge mETH for cmETH on Mantle and from here you’ve got all kinds of opportunities to farm with cmETH.

Liquid Stake with stETH - 4.2% APY

Little needs to be said here—Lido remains the largest liquid staking protocol with over $25B in staked ETH, earning an estimated 4.2% APY with stETH.

Why I like it: It’s easy, safe, and predictable yield, with integrations across virtually every major protocol in DeFi.

How to farm: Just go to lido.fi and follow the prompts to deposit ETH for stETH. From there, you can do everything from borrow against stETH to LP to looping against it as a yield-bearing token. You can even go back to my section earlier on Fluid and lend wstETH to Fluid borrowers.

Stake + Lend with Origin Super OETH - 5.29% APY

Origin Protocol created a new Super OETH liquid staking token on Base using code from its flagship OETH token. They refer to Super OETH as “the first Supercharged LST offering blended yield from Ethereum's Beacon Chain and L2 incentives, with substantially higher yield and a similar risk profile compared to LSTs.” Super OETH is for users seeking to maximize yield on their ETH.

Super OETH sources its yield from Beacon Chain yield via bridged Wrapped OETH and rewards from Aerodrome through a protocol-owned, concentrated liquidity position on Base.

Why I like it: The baseline yield of 5.29% APY is very competitive with staking rates. The code behind OETH which powers this newer version of Super OETH has been around for years with over $320M in this hybrid liquid staking token.

How to farm: I can acquire/mint superOETHb on Base with ETH here on the Origin app.

Restake with eETH + Lend to Liquid Vault - 9.6% APY

This cycle, ether.fi has grown to become the 4th largest protocol across all chains, with just under $7B in assets. It started with their flagship LRT eETH, which currently is earning 4.6% APY. eETH on its own is a standout opportunity and one I’ve personally deployed more liquidity into over the last few years.

A part of their success has been offering these passive Liquid vaults for maximizing yield with their LRTs for EigenLayer, Karak, and Symbiotic. The Liquid ETH Yield vault is earning an estimated 9.6% APY in staking yield + ETHFI + KING rewards, with $437M TVL.

Why I like it: This is a massive vault with deep liquidity for big players, competitive passive yield, and a proven track record for reliably withdrawing from the vault (72 hours or less).

How to farm: I can go direct to the Liquid ETH Vault here and deposit with WETH, eETH, or weETH.

Neutral Trade ETH Super Staking Vault - 23.7% APY

For this last farm, I’ll break from my criteria because this vault has only $500k more capacity to fill, but I suspect they’ll be raising caps sooner than later.

With over $47M TVL, Neutral Trade created the ETH Super Staking Vault to earn trading fees, borrowing fees and liquidation fees from traders on Jupiter perp DEX using JLP, while hedging out SOL and BTC exposure to create an ETH directional bet. This strategy is monitored 24/7 systematically and “dynamically leveraged based on predicted fees with minimum delta exposure” but I want to acknowledge this carries more risk than the other strategies above. This hedge fund strategy is run onchain by the Neutral Trade protocol and team.

Why I like it: Given all the trading activity on Jupiter on Solana and all the fees generated, this is one of the few ways to stay long ETH, earn more ETH, and benefit from the trading activity on Solana.

How to farm: I can deposit WETH on Solana here in the Neutral Trade app.

Follow @DeFi_Dad on X (Twitter)

Follow @Nomaticcap on X (Twitter)

Subscribe to The Edge Podcast via Linktree

Reply